Retire in comfort with Lifetime Payout (Singlife Savvy Invest II)

*Terms and Conditions

1.) Past performance is not necessarily indicative of future performance.

A.) The advertisement’s illustrated return payout from 1st month is a potential 6.5% per annum dividend distributed monthly and is based on the average dividend yield of two funds available under the investment-linked insurance policy. The two funds have an annualised dividend yield of 6.51% (SGD class, dividend rate of $0.04547 per unit per month at SGD$8.38 correct as of 30 October 2024 – PIMCO INCOME FUND CL E INC SGD-H) & 6.62% (SGD class, dividend rate of $0.04131 per unit per month at SGD$7.71 correct as of 15 October 2024 – ALLIANZ INCOME AND GROWTH CL AM DIS H2-SGD). Past payout yields do not represent future payout yields and payments. Historical payments may comprise of distributable income or capital, or both. The declaration of distribution is at the sole discretion of the Fund Manager and is not guaranteed. The dividend information is for your reference only and it is not indicative of future performance. The rates of return used are before deducting the charges of the investment-linked insurance policy. You may be exposed to market, currency and other investment risks. Clients must be prepared to invest for the long term as early surrender of policy will result in much lower returns.

B. The views and opinions expressed in this advertisement are those of the author and do not reflect the official position of any other agency, organization, employer or company. This advertisement has not been reviewed by the Monetary Authority of Singapore.

2.) Bonuses

There are three types of bonuses the plan comprises if you meet the following requirements:

A.) Welcome Bonuses

B.) Additional Welcome Bonuses

C.) Loyalty Bonuses

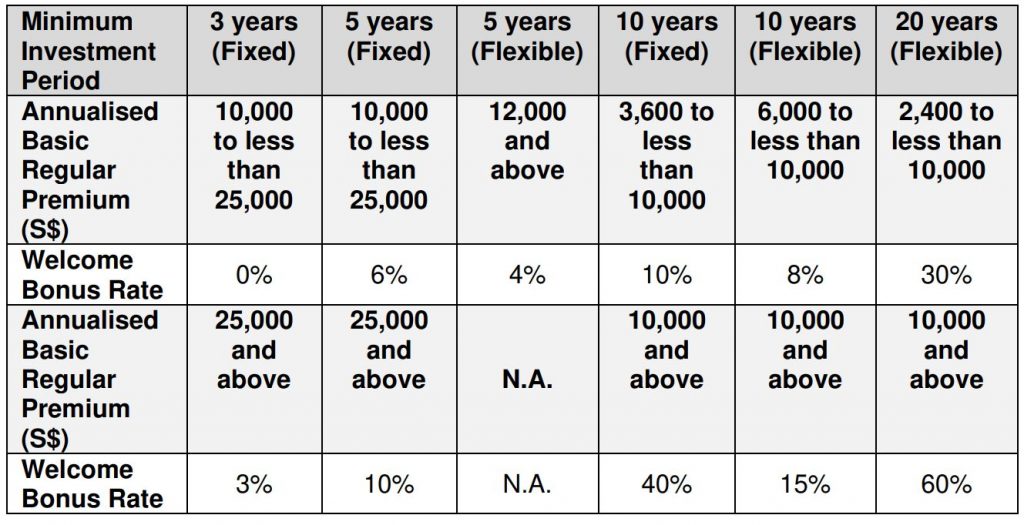

A.) Welcome Bonuses (As shown in the product summary)

Welcome Bonus will be given in the form of additional units base on a rate of the first 12 months regular basic premium paid, excluding top-up premiums. The additional units are payable according to your pre- specified basic premium allocation.

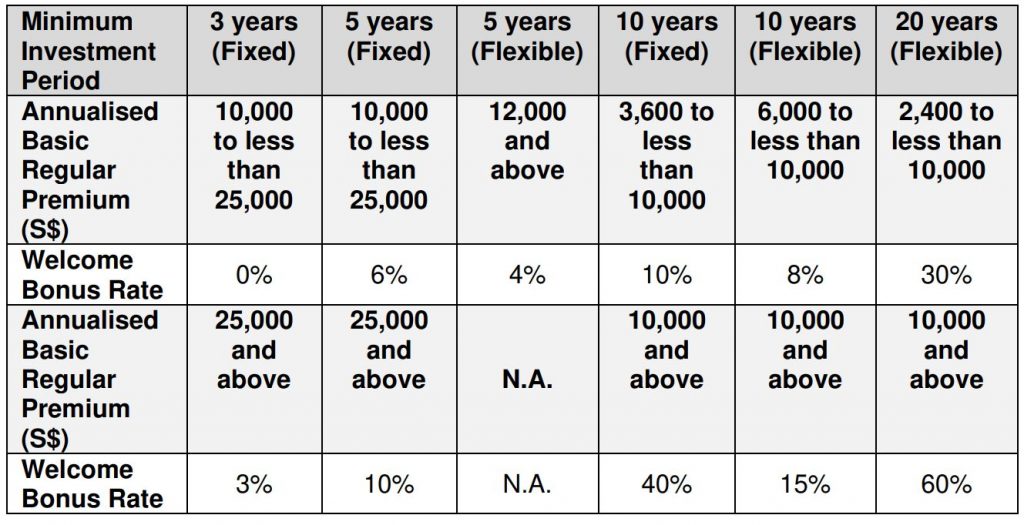

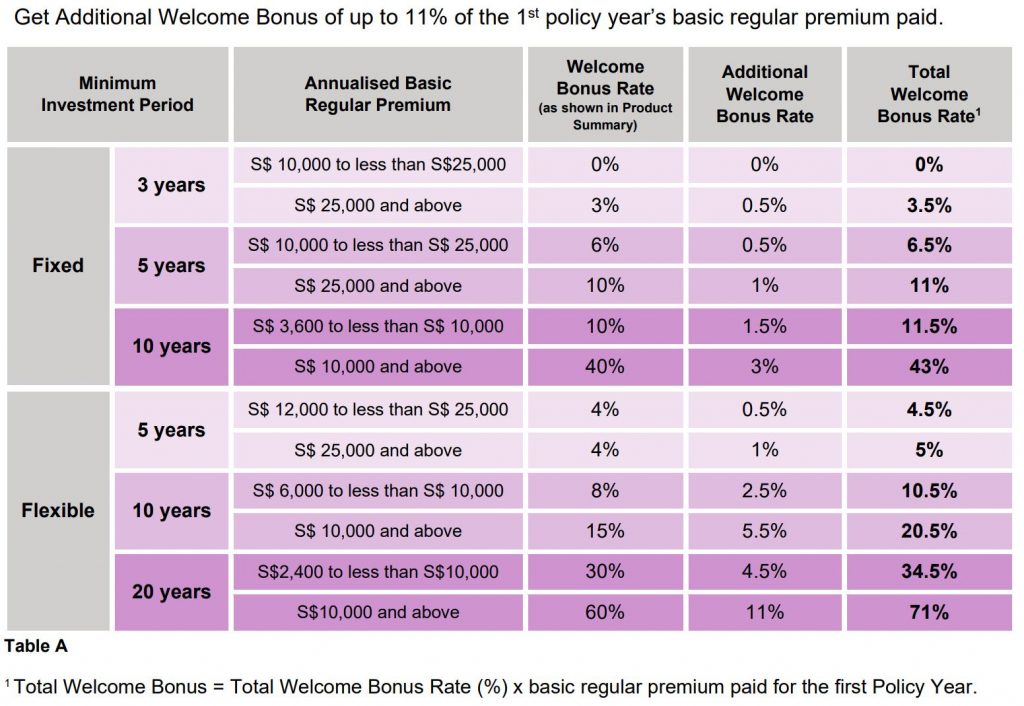

Welcome Bonus rate is based on the table below:

B.) Additional Welcome Bonuses

A one-time Additional Premium Bonus will be given during this promotional period from January 2025. The Additional Premium Bonus is calculated as a percentage of the first policy year annual basic premium paid. This bonus will be converted into additional units according to your upon receipt of your first annual basic premium.

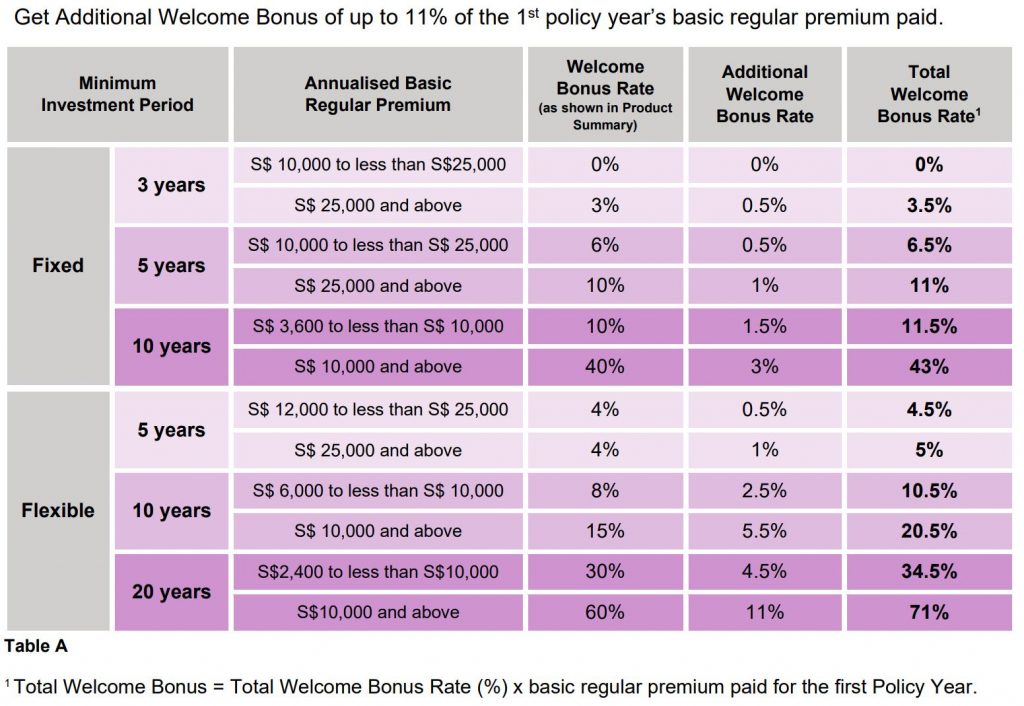

Additional Welcome Bonus Rate under the Additional Welcome Bonus Rate column in table below:

C.) Loyalty Bonuses

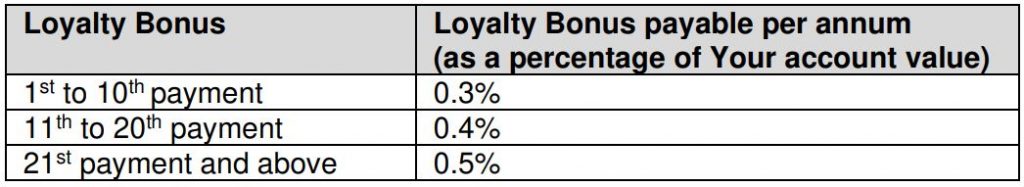

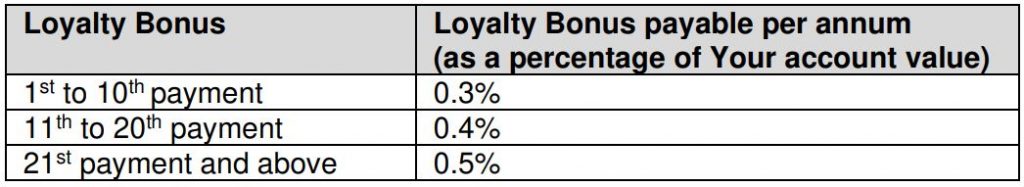

Loyalty Bonus will be given during the policy term starting from the policy anniversary immediately after the end of the Minimum Investment Period (MIP) and subsequently every policy provided the following are criteria are satisfied:

i. Your policy is in force at the point when the Loyalty Bonus is payable; and

ii. You have not made any withdrawals on the policy in the last 12 months from the point when the Loyalty Bonus is payable, except for withdrawals under the Life Stage Benefit (please refer to product summary below if required).

If You do not qualify for the Loyalty Bonus on any policy anniversary, You will still be eligible for the next

Loyalty Bonus if the conditions stated above are met.

3.) Charges

A.) Administrative Charge

There will be an administrative charge of 0.65% per annum of the account value that is payable on every monthly anniversary date throughout the policy term and it will be deducted by cancelling units from your account value on the next appropriate fund valuation date immediately after each due date of the administrative charge. This charge will continue to be payable during premium holiday. The administrative charge is not guaranteed and Singapore Life Ltd (the insurer) reserves the right to increase this charge by giving You at least 30 days’ written notice.

B.) Supplementary Charge

A supplementary charge of 1.85% per annum of the account value is payable on policy effective date and every monthly anniversary date thereafter for the first 10 policy years and it will be deducted by

cancelling Units from Your account value on the next appropriate fund valuation date immediately after each due date of the supplementary charge. This charge will continue to be payable during premium holiday. The supplementary charge is not guaranteed and Singapore Life Ltd (the insurer) reserves the right to increase this charge by giving You at least 30 days’ written notice.

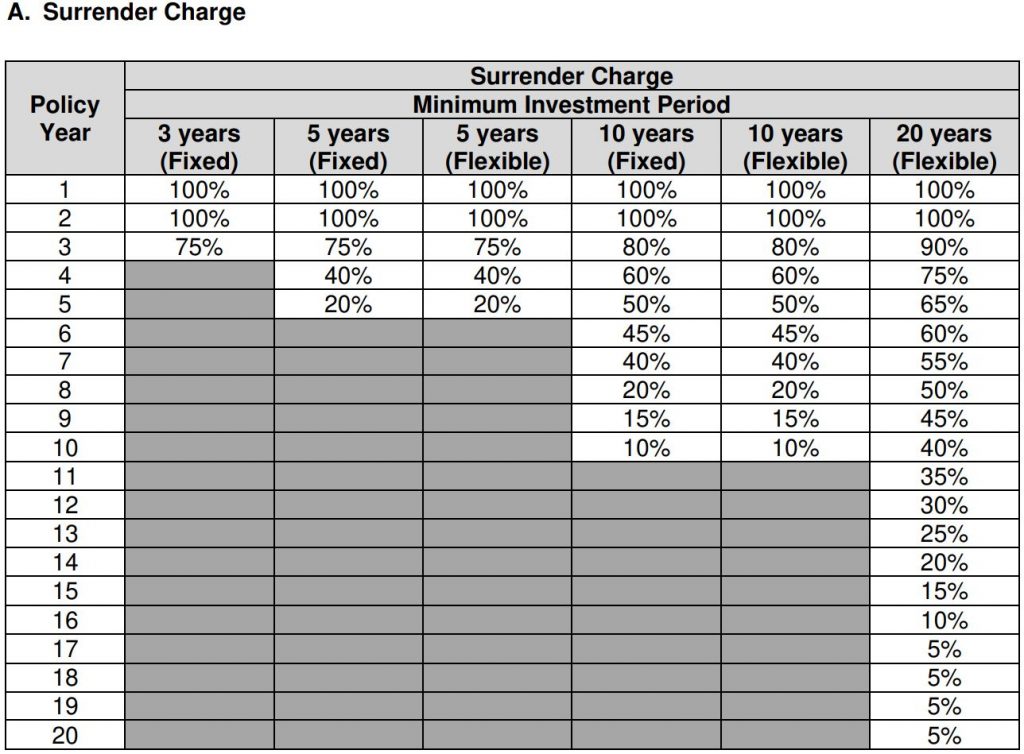

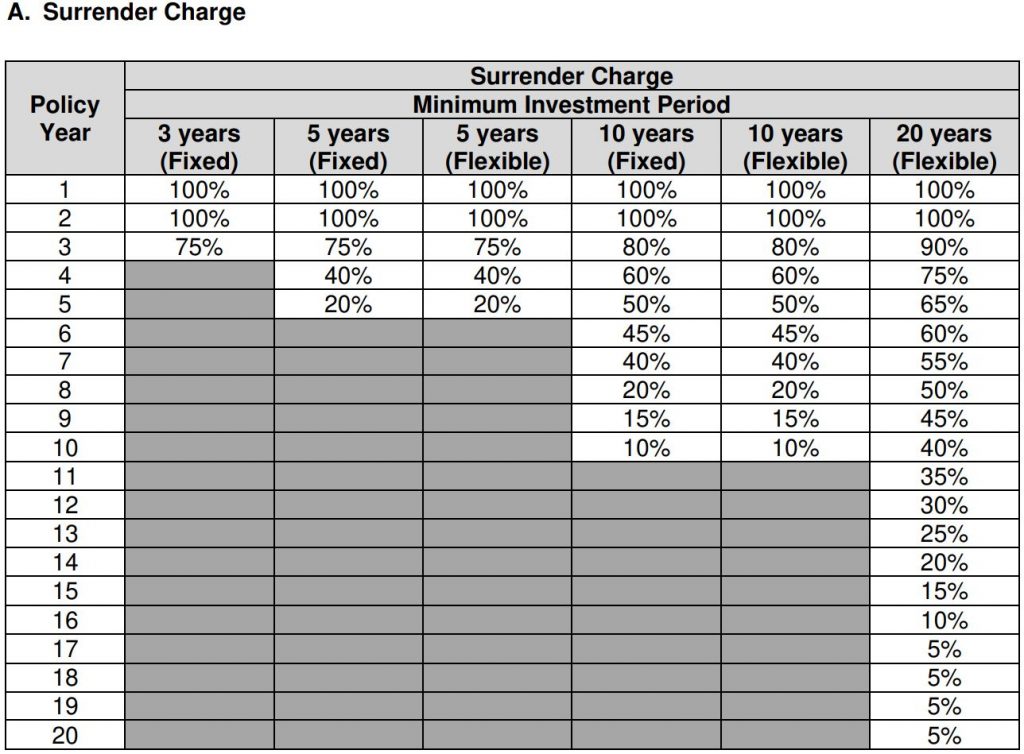

C.) Surrender Charge

Surrender charge applies if you request for full surrender during the Minimum Investment Period (MIP). The surrender charge will be deducted from the sale redemption proceeds of all units. Any balance after deducting the surrender charge and any other amounts owing to Singapore Life Ltd (the insurer), will be paid to you.

It will be calculated as a percentage of the account value:

Applicable surrender charge rate (%) x units surrendered x unit price of respective ILP sub-fund(s)

The surrender charge percentage rate table is as follows:

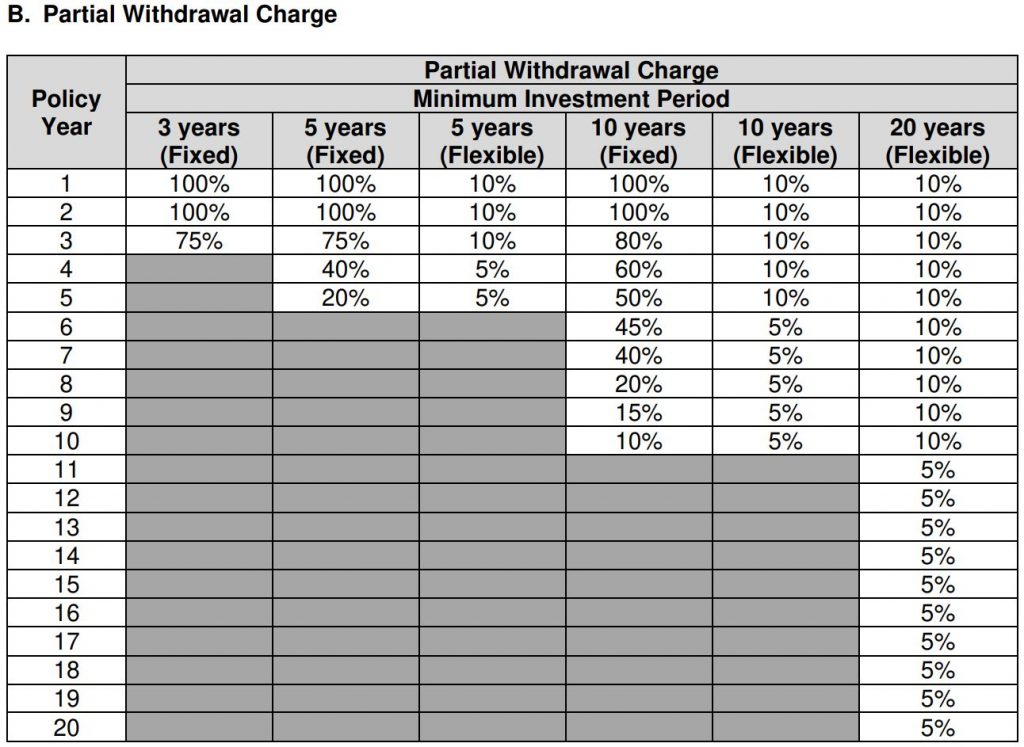

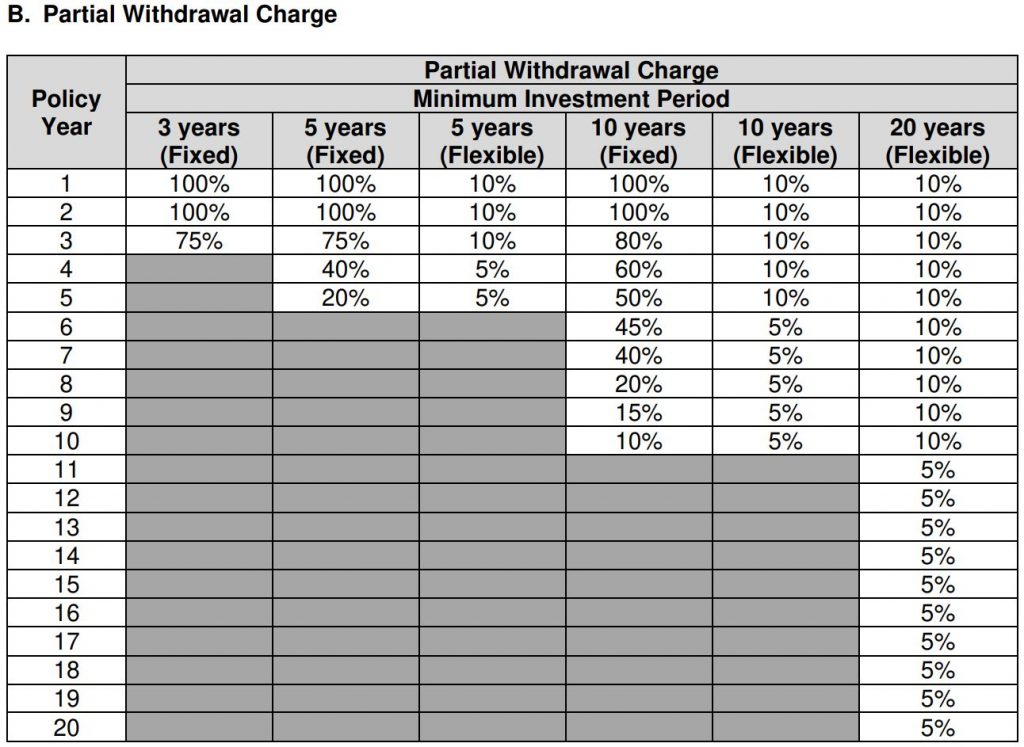

D.) Partial Withdrawal Charge

Partial withdrawal charge is charged upon each partial withdrawal that You make on the policy before the Minimum Investment Period (MIP) ceases, except for partial withdrawal made under the Life Stage Benefit. It will be deducted from the partial withdrawn amount. It will be calculated as a percentage of the account value:

Applicable partial withdrawal charge rate (%) x number of units of specified ILP sub-fund(s) to be partially withdrawn x unit price of specified ILP sub-fund(s)

The Partial Withdrawal Charge percentage rate table is as follows:

=> Please click here for Full Product Summary <=

=> Please click here for Fund Factsheet 1 <=

=> Please click here for Fund Factsheet 2 <=

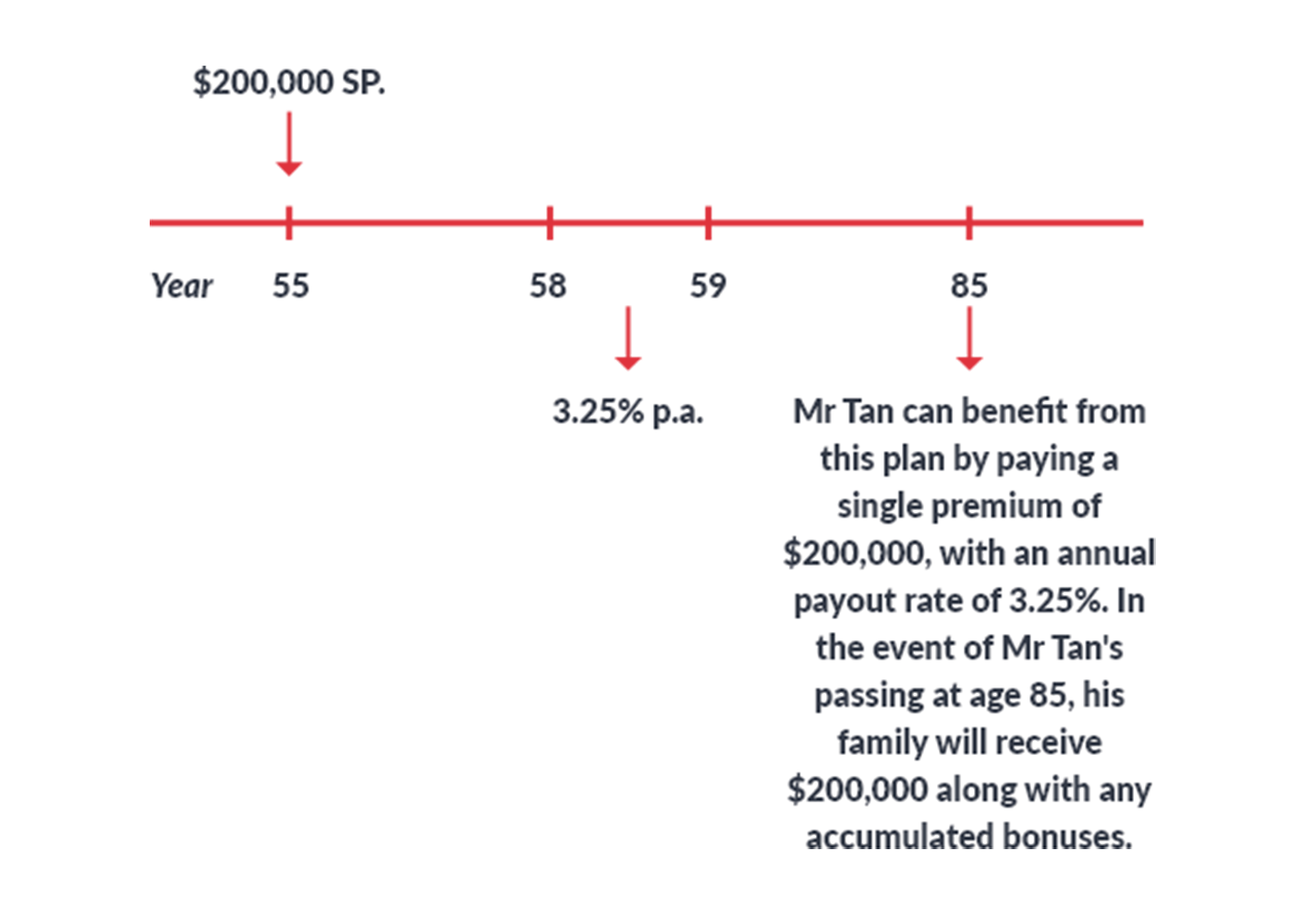

Retire in comfort with Annuity Payout (Singlife Flexi Life Income II)

Based on Male 55 years old Age Next Birthday 56. 3.25% p.a.* is derived from Singlife’s 4.25% illustrated payout of $6500 as shown in the illustration divided by a supposed single premium of $200,000. For the actual and precise figures, please view the full product summary below.

=> Please click here for Full Product Summary

Calvin Lim Insurance

Calvin Lim Insurance